UNLEASHING THE POWER OF PREDICTIVE MODELING INTO BROADER USES SHOWS GREAT POTENTIAL IN AN INDUSTRY THAT HAS BEEN SLOW TO ADOPT DATA ANALYTICS.

The insurance industry’s use of predictive data analytics reminds one of Aristotle’s famous phrases, “The more you know, the more you don’t know.”

While the industry has taken great strides in using models to better price its products for underwriting, marketing and competitive purposes, it’s still just scratching the surface.

Nevertheless, the pace at which insurers and brokerages are beginning to leverage predictive data analytics is so rapid that state insurance regulators are struggling to understand the impact of this more widespread use on consumers of insurance. In May the National Association of Insurance Commissioners published a report on price optimization that urges insurers to be more forthcoming about the models they use to underwrite personal lines and commercial automobile insurance.

After years of toying around with data analytics, the property-casualty and health and benefits industries are now investing fully in the technology. This makes abundant sense, as few businesses are as data intensive as insurance carriers and brokerages. By analyzing the statistical relationships among multiple data sets, insurers acquire remarkable insights into each client’s potential risk frequency and severity, assisting more competitive pricing, greater customer loyalty and wider profits.

Brokers undertaking the same analyses, on the other hand, are better equipped to match a client’s risk profile with carriers that have an appetite for this business. By illuminating the potential loss factors of a particular client based on its industry, geographic location, loss history, size and financial strength, among myriad other factors, brokers tame this big data to their clients’ needs, improving client satisfaction and loyalty.

These efforts, by and large, are still in their infancy. But the industry has come a long way in a short time.

Insurers Digging In

Let’s first look at the growing use of predictive models by insurance companies. While much of the ink is devoted to the use of sensors and cameras attached to automobiles to acquire insight on driver performance for pricing purposes, other interesting developments also are under way in commercial lines. ACE Group, for example, is leveraging both structured and unstructured data to improve workers compensation claim outcomes.

Structured data, in the context of workers comp, is the traditional line-item view of a claim, beginning with the claims report and closely followed by the initial investigation. The information an adjuster gathers at this stage includes the employee’s injury or work-related illness and his age, occupation, job tenure, initial medical diagnosis, medications and expected subsequent visits, to cite just a few of these structured data points.

Where ACE Group is altering the paradigm is in its use of unstructured data to improve claims management. “We’re capturing in our predictive models key terms from the claim notes that are customarily entered by claims adjusters during the course of the claim,” explains Keith Higdon, the insurer’s vice president of claims data analytics.

Adjusters routinely compile such notes during the initial investigation of the claim, through subsequent medical reports, legal notifications and conversations with the claimant, medical providers and employer. This unstructured data may indicate, for example, that a claimant has commented more than once about pain, is overweight or is under severely stressful conditions at home or at work. The notes might also reveal that a claimant has a diabetic condition or other health-related issue, which was unknown at the time of the claim filing but happened to be mentioned by the employee in conversation with the adjuster.

In the past, this information could escape application beyond a specific claim or single claims team. Using predictive modeling, this is no longer the case. “We’re applying algorithms that extract insight from both the traditional structured data and the unstructured data,” Higdon says. “For example, the model [the engine behind ACE 4D] can determine if the frequency of the word ‘pain’ in the notes suggests claim severity, thus requiring greater focus and deliberate actions. These notes are crucial to improving the claim’s outcome. By combining this unstructured data with traditional data sets, the accuracy of the predictive analytics increases.” ACE Group is currently extending the claims analytics to other risks, such as employment practices liability and casualty bodily injury.

Other insurers also are making headway with data analytics. At Chubb, Jeff Hoffman, senior vice president of commercial strategic marketing, says the insurer has successfully used predictive modeling to identify insurance prospects. “We’re merging our internal customer data with external data from a vendor on a customer’s recent buying history to identify the customer’s next likely insurance purchase,” Hoffman says. “We then provide this insight to agents and brokers in the local market.”

Chubb also is using data analytics to win back commercial lines business lost to other insurers. “We’re mining past accounts that have very similar characteristics to an existing valuable client,” Hoffman says. “We then reach out to the agent who last wrote the account to discern ways to repatriate the business.”

CNA Insurance is similarly focused on generating distinctive risk insights from its predictive models. The insurer contacts both third-party vendors and government sources for relevant external data, which it analyzes for underwriting and pricing purposes in concert with its own internal data. For instance, the company purchases business intelligence from Dun & Bradstreet and SNL Financial to discern a commercial client’s or prospect’s financial condition, which is then integrated with other data points into its pricing calculations.

“Financial strength is a really important indicator of how well a company is managed, which has a strong correlation to how well they manage risk,” says Nate Root, CNA’s senior vice president of shared services. The insurer also has invested in weather-related data from the National Oceanic and Atmospheric Administration to correlate this information with physical structures and building codes to predict potential claims outcomes. And it is mining its own data to determine the supply chain connectedness of different insureds, where 10 accounts, for example, may rely on the same sole supplier. “It’s important to know where and how risks are correlated,” Root says.

Insurance brokers agree accessing both structured and unstructured external data is vital to analyzing the risk potential of their clients at granular levels of detail. “We need and want a broader sample than our own private world,” says Anne Anderson, president of U.S. operations at Integro Insurance Brokers in New York. “We already have operational metrics on clients, employees and carriers. It’s the external data and the benchmarking around it that helps us match a client with the right carrier with the best appetite for its business.”

Brokers Begin Their Advance

Brokers have a different purpose in mind when they use predictive modeling and data analytics—to ensure an account is aligned with an insurance carrier that provides optimum risk transfer at the most cost-effective price. This service assists brokers’ ability to effectively meet the needs of prospective clients and ensure continued loyalty among current accounts.

The latter is especially critical. “U.S. brokers generally are under the threat of disintermediation by companies like Google and Facebook, assuming these organizations provide advanced aggregated data analytics to our clients for insurance reasons,” says Ravi Krishnan, chief information officer at broker Woodruff-Sawyer & Co. in San Francisco. “Consequently, we must utilize and exploit the power of data analytics to make ourselves stickier.”

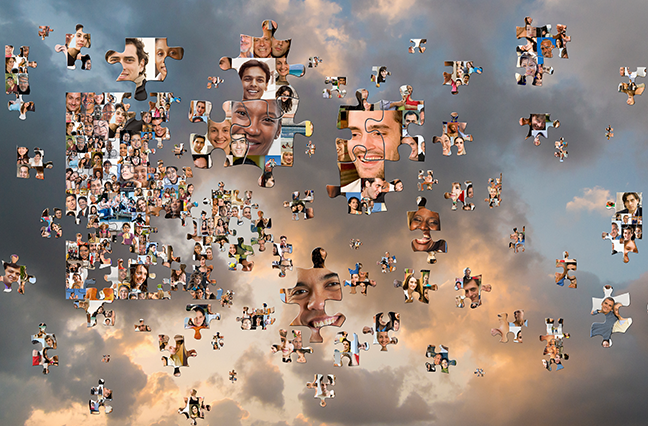

Sharing this perspective is Claude Yoder, head of global analytics at Marsh. “The modeling is important, but so is the visualization of the sophisticated analytics,” Yoder says. “Arguably, this is the most important piece of the puzzle, then getting it in the hands of the right people to make actionable decisions.”

He adds that, with data analytics, a brokerage first must determine the modeling technology it is going to use to harvest the data and apply the related analytics. Then it must create an application that extracts real-time insights from these exercises and provide this knowledge to end-consumers in very visual and dynamic ways. “Otherwise, the client won’t realize the import,” Yoder says.

Both Marsh and Woodruff-Sawyer undertake this two-part process. “We use our own algorithmic recipe to blend information from insurance carriers with internal and external data to determine carrier-client suitability,” Krishnan says. “Then we present this insight to clients in a very customized manner, which reestablishes our necessity.”

This highly persuasive form of marketing involves showing an existing or prospective client its potential loss frequencies, severities and trajectories, based on its business type, geographic location, strategic goals and myriad other factors, including the political stability and economic climate of a country in which the company operates.

“Each of these many different risk factors, when dialed up or down, alters the loss picture, which then affects the nature of the premiums the client will pay,” Krishnan explains. “Now imagine showing all this in a very visual way.”

Woodruff-Sawyer does just that, taking this information and putting it into a concise, dynamic sales script that ultimately points to the one or two carriers that best match a client’s need for risk transfer. “No longer do our brokers have to bring along an 85-page PowerPoint presentation to make the case for choosing us,” Krishnan says. “It’s all on a mobile tablet.”

The firm has harnessed the power of data analytics to make the broker selection process easier and more convincing by giving prospective clients a far more precise assessment of their risks, tailored to them on an individual entity basis through highly visual means. “Once we do that, we can then flip the analytics around and present it to our carrier partners, offering them clients that best fit their particular insurance specialties, risk appetites and market diversification needs,” Krishnan says.

Marketing

At Willis, data analytics also is being leveraged for marketing purposes, applied to clients on an individual account basis across the entire client base. “We can stack up two peer companies in the same industry that are the same size, and through our own internal data and benchmarking and indexes culled from a wealth of external data, separate each company by its specific exposures,” says Ben Fidlow, global head of core analytics in Willis’s New York office.

This external information runs the gamut of diverse economic, financial, geopolitical, and industry-sector data. A breakdown of revenue by industry segment, for example, provides informative benchmarking data that can be correlated with a client’s specific business risks. “Say we do some text mining of annual reports in an industry segment,” Fidlow says. “We can then compare the client’s overall corporate revenues and exposures to these benchmarks, right down to the business unit.”

Marsh has developed a client-facing application that captures the client’s risk profile, modeling its own aggregated data along with the client’s data to produce a depiction of what the client can expect in terms of risk.

“The model may indicate the client has a certain probability of experiencing certain types of losses and what these would look like,” Yoder says. “We overlay their financial considerations to withstand certain risks and their appetite for taking on the risk, whether they are risk hardy or more conservative.”

This forms a foundation for further discussion regarding how best to transfer these losses. “This is far more predictive and dynamic than the view presented by traditional RMIS [risk management information systems],” Yoder says. Marsh has developed another online application called MarketConnect that assesses insurance market appetite—the kinds of risks carriers seem most interested in absorbing at the present time. Both tools work together to assure more refined placement of risks.

Brokerages’ overarching goal for data analytics is to acquire a better understanding of their clients’ specific vulnerabilities, which then fuels conversations between brokers and clients on how to mitigate these risks.

“We’re just scratching the surface on risk factors, where before we weren’t sure if they had an impact because we couldn’t quantify them,” Fidlow explains. “Now that we can mine data on corporate governance and the state of the stock market and use algorithms that correlate these metrics with other data, we can get a better view of a client’s D&O liability potential.”

He adds, “This makes for a more strategic and dynamic engagement with the client, helping us differentiate our value in ways we couldn’t in the past.”

Obviously, a cleaner connection between clients and carriers is crucial to making good on a broker’s value proposition. But data analytics also makes the business of broking simpler and more effective than the status quo.

“Today, it’s common for a carrier marketing rep to keep knocking on the door to talk about the value of a particular product, only to then decline a dozen submissions in a row,” Anderson says. “By synching up a client’s risk profile with a particular carrier’s appetite for this business, everyone wins—the client, the broker and the carrier.”

This article was originally published by Leader’s Edge Magazine.